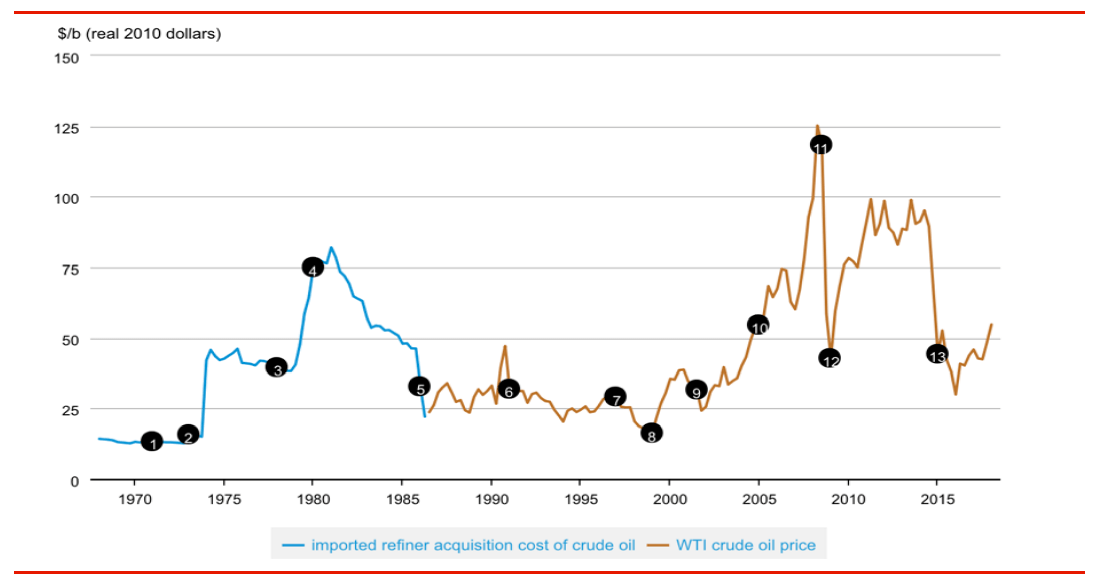

According to the price of crude oil from U.S. WTI, U.K. Brent and OPEC from 2016 to 2018, the oil market is integrated globally and the crude oil prices tend to be consistent. Short-term and medium-term crude oil prices are a reflection of major global economic events and political changes, while long-term crude oil prices are mainly determined by supply and demand.

Most of the world's crude oil is located in areas prone to political turmoil in history. As a result of political events, oil production has been interrupted, supply exceeds demand and prices have risen. In particular, the Arab oil embargo from 1973 to 1974, the Iranian Revolution and the Iraq War in the late 1970s and early 1980s, and the Persian Gulf War triggered several major oil price shocks. Global economic events also have a significant impact on oil prices, such as the Asian financial crisis at the end of the 20th century and the global financial crisis in 2008. The economic downturn has led to the shortage of global demand for crude oil, and crude oil prices have all dropped by different degrees.

In the long run, oil price trends are determined by global oil supply and demand.

According to the year-end statistics of the American Journal of Oil and Gas, in 2016, the global oil production was about 3.92 billion tons, OPEC oil production was 1.66 billion tons, accounting for 42.3% of the world's production. Especially as OPEC's largest producer and the world's largest oil exporter, Saudi Arabia accounts for 13.3% of its total output with an annual output of 520 million tons, its crude oil production change signs often become one of the main driving force of oil price fluctuations.

The current level of economic growth has a clear correlation with global oil demand and oil prices, especially the GDP growth rate of non-OECD countries is closely related to the growth of oil consumption, therefore it also has a significant impact on oil prices. In addition, oil demand is also related to the national industrial structure. Since the energy-intensive manufacturing industry accounts for a high proportion in the industry in developing countries, oil is still an important fuel for power generation in the energy consumption structure, so the demand for oil has a great growth potential.

-

2025 / 12 / 29

Customized Shell and Tube Heat Exchanger for Syria Project

Customized Shell and Tube Heat Exchanger for Syria Project -

2025 / 11 / 01

HC Successfully Delivers Gas-Liquid-Sand Separator for Xinjiang Oilfield Project

HC Successfully Delivers Gas-Liquid-Sand Separator for Xinjiang Oilfield Project -

2025 / 08 / 20

HC Successfully Delivered Filter Coalescer Skid to Malaysia

HC Successfully Delivered Filter Coalescer Skid to Malaysia

- +86 158 6190 3617